SoftBank Invests $40B in OpenAI: What This Means for AI Agents, Stargate, and Meta–Manus

Quick Summary

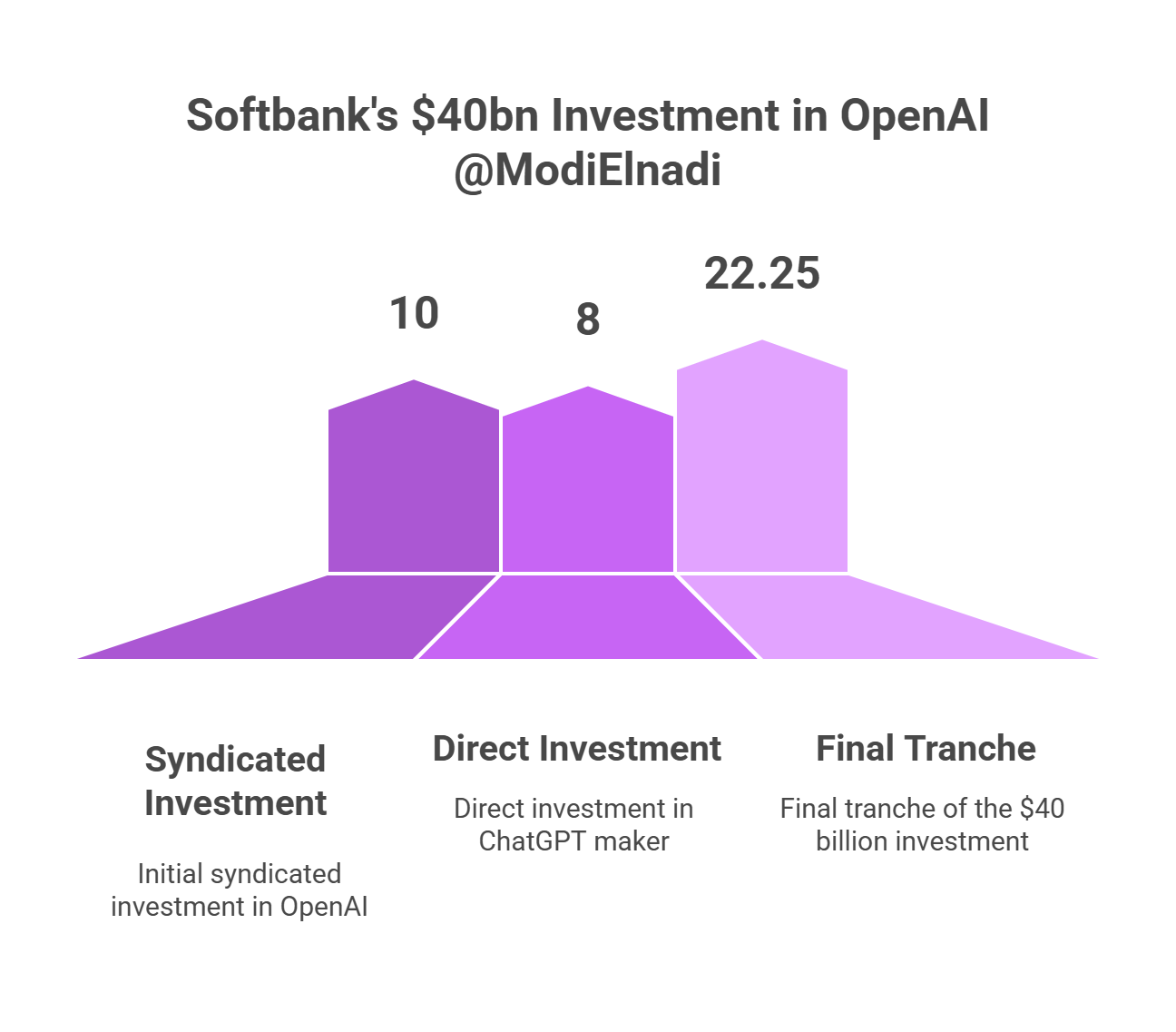

SoftBank has reportedly completed (fully funded) its $40 billion investment commitment to OpenAI, per CNBC sources cited by Reuters. (Reuters)

This materially reduces OpenAI’s financing uncertainty and reinforces the infrastructure-first thesis behind Stargate (OpenAI–Oracle–SoftBank). (OpenAI)

Public-market “read-through” concentrates in AI infrastructure proxies (data centres, connectivity, power) and partners like Oracle, not in OpenAI directly (private). (Financial Times)

Meta’s acquisition of Manus is a parallel move: buying agentic capability + talent to accelerate Meta AI’s “do-things” workflows. (Reuters)

Net impact: 2026 becomes a two-front race—compute + distribution—and the winners will increasingly be those who can control both.

What It Means for AI Agents, Stargate, and Meta–Manus

SoftBank has reportedly completed its $40B investment commitment to OpenAI, according to sources cited by CNBC and reported by Reuters. (Reuters) In plain English: this shifts OpenAI from “promised capital” to “banked capital,” reducing execution risk and signalling that SoftBank is willing to underwrite OpenAI’s scale-up at the very moment the industry’s bottleneck is compute.

Context that matters: SoftBank and OpenAI publicly discussed a $40B round in 2025, with SoftBank also describing syndication mechanics and follow-on investment structure in its own disclosures. (ソフトバンクグループ株式会社) OpenAI separately positioned the funding as fuel for frontier research and compute expansion. (OpenAI)

Where the money likely goes: Stargate, data centres, power, and “agent readiness”

If this $40B is “war chest,” the near-term battlefield is infrastructure: data centres, energy, networking, and the capex stack required to run next-gen models and agents. OpenAI’s Stargate framing is explicit: a plan to invest $500B over four years, beginning with $100B immediately, to build AI infrastructure in the U.S. (OpenAI) OpenAI later posted updates about expanding Stargate with new sites and a 10-gigawatt target by end-2025. (OpenAI)

My POV: this is not just “more GPUs.” It is OpenAI (with SoftBank/Oracle) pushing toward a vertically reinforced moat where product velocity (agents, multimodal, enterprise) is constrained less by model ideas and more by throughput and unit economics.

What stock markets are “pricing” in the last 24 hours

Public markets can’t buy OpenAI, so they trade the proxies:

Infrastructure aggregators: SoftBank’s separate move to buy DigitalBridge (data-centre/digital infrastructure exposure) is being read as a “pipes and shovels” reinforcement of the Stargate thesis. (Financial Times)

Ecosystem partners: Oracle has become a market barometer for AI infrastructure optimism (and AI-bubble anxiety), precisely because it sits close to the data-centre monetisation layer. (Yahoo Finance)

SoftBank itself: market trackers showed SoftBank trading lower on the day the OpenAI completion headline circulated, highlighting that investors are still debating whether this capex cycle is a durable cashflow engine or a bubble top. (MarketScreener)

One additional “tell”: SoftBank has openly discussed funding pressure and asset sales to meet OpenAI-related commitments in recent reporting. (Reuters) That matters because it frames the $40B completion as a real capital-allocation pivot, not a casual cheque.

What it means for OpenAI’s competitive Agentic AI posture in 2026

This financing milestone strengthens OpenAI in three specific ways:

Compute certainty → product certainty

When compute availability is predictable, roadmaps become less constrained: more agent orchestration, more enterprise SLAs, more experimentation, faster iteration cycles.Negotiating leverage

A fully funded OpenAI can negotiate infrastructure and supplier terms from a stronger position—especially where long-horizon capacity planning matters (power, land, buildout, connectivity).Narrative control

The funding story reinforces “OpenAI is building the platform,” not just “OpenAI ships models.” OpenAI’s own communications emphasise weekly usage scale and the intent to push research plus infrastructure in parallel. (OpenAI)

So how does this impact the Meta–Manus AI Agent deal?

Meta’s acquisition of Manus is best understood as the distribution + agent capability counter-move to OpenAI’s compute + platform move. Reuters and other outlets describe Manus as an “AI agent” startup (with China origins and later Singapore HQ), and Meta has addressed governance steps around severing China ties post-acquisition. (Reuters)

The strategic map

| Dimension | OpenAI + SoftBank | Meta + Manus |

|---|---|---|

| Primary moat | Compute access + infra scale | Distribution + product surfaces (apps, social graph) |

| Speed lever | Capital intensity (capex) | Integration intensity (shipping into consumer workflows) |

| “Agent” advantage | More capacity for tool-use, planning, long-context workloads | Acquiring agent talent/IP to accelerate Meta AI “do” features |

| Key risk | ROI discipline, capex payback, regulatory scrutiny | Data/privacy scrutiny, integration complexity, geopolitics |

The SoftBank funding completion makes Meta’s Manus bet more urgent, not less. If OpenAI can scale agent inference cheaply and reliably via Stargate, Meta needs differentiated “agent distribution” and proprietary workflows inside Meta’s ecosystem. Manus gives Meta a faster on-ramp—especially as the industry converges on agents as the next UI layer.

Also, there’s a second-order effect: mega-rounds tend to reprice the entire startup market. When OpenAI is funded at this scale, “agent-native” companies like Manus become more strategically valuable—because the market starts to view agents as the monetisation layer sitting on top of models and compute.

This is the beginning of “cap table SEO” for AI platforms

The marketing analogy is useful: in classic search, you fought for keywords. In agentic AI, you increasingly fight for default routing—which model, which tool, which agent, which marketplace gets called first.

SoftBank fully funding OpenAI accelerates a world where:

Compute becomes the new distribution (capacity = reliability = default choice for enterprises).

Distribution becomes the new model advantage (Meta can put agents into daily consumer behaviour at unmatched scale).

The winners will be the players that connect both ends: compute certainty + distribution certainty.

Softbank OpenAI Investment FAQs

Did SoftBank really pay the full $40B already?

Reuters reports CNBC sources saying SoftBank has completed the $40B investment commitment; neither SoftBank nor OpenAI immediately commented in that report. (Reuters) SoftBank’s earlier disclosures describe an “up to $40B” structure with syndication elements, which is directionally consistent with large staged funding. (ソフトバンクグループ株式会社)

What does this mean for Stargate specifically?

It strengthens the probability that Stargate’s infrastructure roadmap remains funded and on schedule. OpenAI has publicly described Stargate as a $500B / four-year infrastructure initiative, and later posted progress updates on additional sites and capacity targets. (OpenAI)

Which public stocks are most exposed to this news?

The most direct “read-through” tends to show up in AI infrastructure proxies and partners: data-centre and connectivity players, plus strategic partners like Oracle. DigitalBridge’s move into SoftBank’s orbit reinforces this “infrastructure basket” narrative. (Financial Times)

Does this weaken Meta’s Manus acquisition thesis?

No. if anything it strengthens it. A better-funded OpenAI can scale agent capability faster, pressuring Meta to accelerate agent features inside Meta AI. Manus is positioned as exactly that: an agentic AI capability injection. (Reuters)

What’s the biggest risk to watch in 2026?

The key risk is economics: whether the industry can turn enormous capex into durable cashflows without margin collapse. Even partners close to the infrastructure story have seen “AI bubble” debate become part of their equity narrative. (Yahoo Finance)