Top 10 AI Startups in UK - January 2026

AI investment in the UK is accelerating again, and Synthesia’s confirmed $200m Series E at a $4bn valuation is a clear signal that enterprise-first AI scaleups are setting new benchmarks. This January 2026 guide ranks 10 leading UK AI startups, from Wayve and Quantexa to Tractable and Causaly, using an accuracy-first lens: measurable outcomes, governance, distribution, and unit economics.

OpenAI IPO Hurdles vs Anthropic

As OpenAI and Anthropic move closer to potential IPOs, copyright litigation, regulatory scrutiny, and cashflow sustainability are emerging as decisive investor risks. This in-depth analysis examines why Anthropic appears more IPO-ready than OpenAI, how unresolved copyright lawsuits could delay listings beyond 2026, and how OpenAI’s projected $25bn advertising revenue by 2030 reshapes its financial outlook.

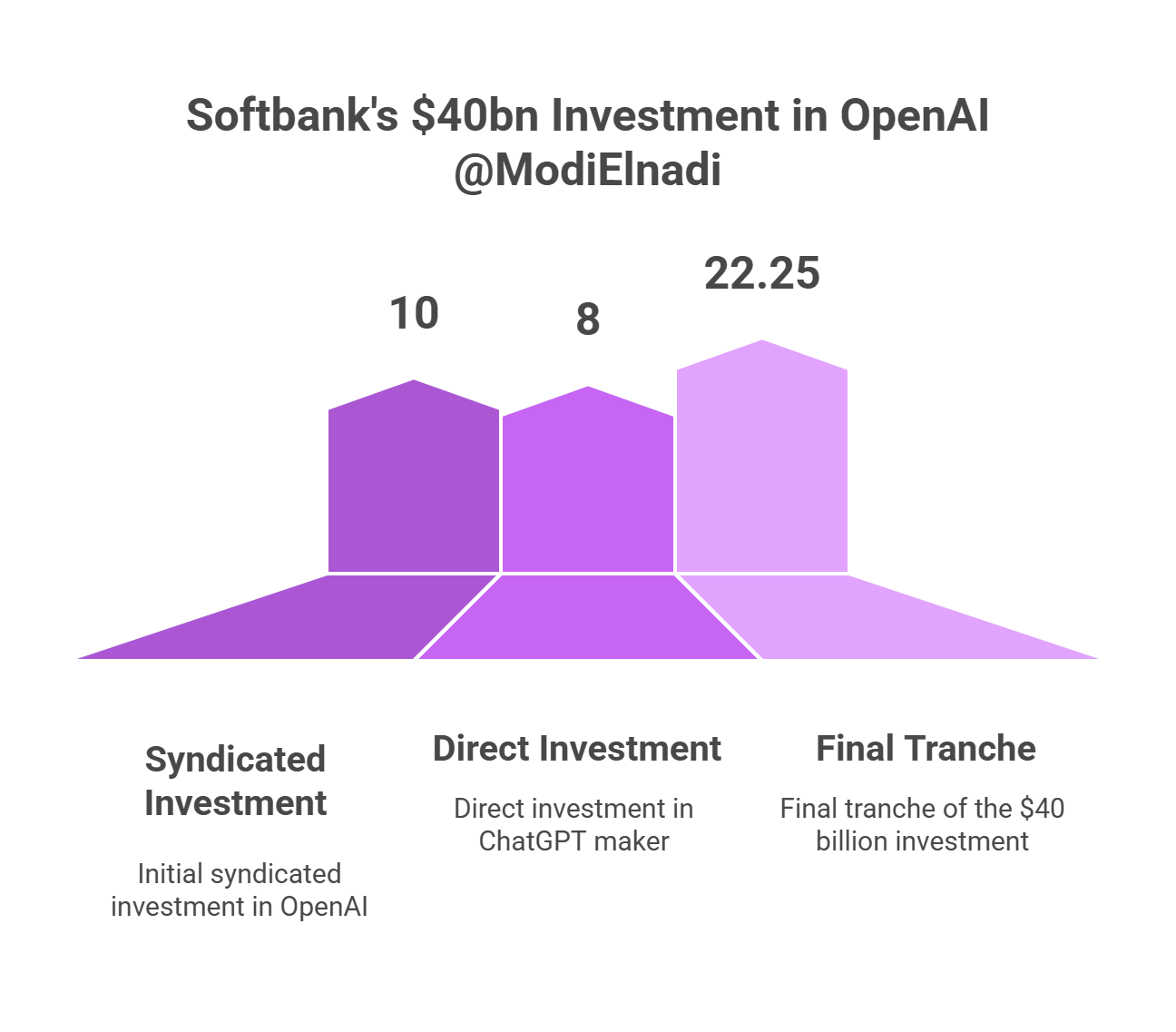

SoftBank Invests $40B in OpenAI: What This Means for AI Agents, Stargate, and Meta–Manus

SoftBank has reportedly completed its full $40 billion funding commitment to OpenAI, removing a major financing uncertainty and accelerating the infrastructure race behind Stargate. The move reinforces OpenAI’s compute advantage just as AI agents shift from demos to real workflows across enterprise and consumer products. For marketers and tech leaders, the signal is clear: platform winners will combine reliable inference capacity with distribution. It also raises the strategic stakes for Meta’s Manus acquisition.

Is the AI Bubble About to Pop? Insights on the AI Bubble Prediction for 2026

Is there really an AI bubble, or are we witnessing one of the largest economic transformations since the internet? In 2025, fears of an AI bubble are growing as investment in artificial intelligence, data centres, and advanced chips accelerates at record speed. Yet the data tells a different story. With ChatGPT reaching around 800 million weekly users, OpenAI generating over $10 billion in annual recurring revenue, and businesses steadily increasing AI adoption, artificial intelligence is no longer experimental—it is operational. This article examines the real pressure points behind the “AI bubble” narrative, including market concentration, infrastructure costs, energy demand, and enterprise ROI concerns. More importantly, it explains why AI is best understood as a long-term automation engine that shifts revenue, boosts productivity, and expands economic capacity. Rather than a speculative bubble, AI represents a foundational re-platforming of work, search, marketing, and decision-making across the global economy.

44 Jobs OpenAI Uses to Measure AI Capability

GDPval is OpenAI’s “real-work” evaluation: instead of exam questions, it measures whether AI can produce economically valuable deliverables professionals would actually ship. It spans 44 knowledge-work occupations across nine U.S. GDP-leading sectors, selected using BLS wage data and O*NET task analysis with a 60% digital-work threshold. The benchmark includes 1,320 expert-designed tasks (plus a 220-task open gold subset) requiring artifacts like legal briefs, nursing care plans, financial spreadsheets, sales decks, and multimedia. Outputs are graded with blind, head-to-head expert preference judgments, complemented by an experimental automated grader. OpenAI notes models can be faster and cheaper on inference, but human oversight and integration matter. In this guide, you’ll get the full list of jobs, the methodology, what the early results imply for AI productivity and AI search, and what comes next: more roles, more multimodal context, and more iterative, ambiguity-heavy workflows. (integrated.social)

ChatGPT 5.2, Gemini 3, and the Real AI Power Shift

Who wins the next phase of AI search: OpenAI’s ChatGPT or Google’s Gemini? In this analysis, Modi Elnadi breaks down what’s happening as GPT-5.2 is reportedly pulled forward under an internal “code red” to answer Gemini 3’s leap in reasoning benchmarks like Humanity’s Last Exam and ARC-AGI-2. The article explains what changed in late 2025, where the battle is playing out (AI Mode in Search, ChatGPT, and enterprise workflows), and why compute economics matter as TPUs challenge GPUs and OpenAI eyes a potential 2026 IPO. It frames the “power shift” through distribution, speed, and cost: Google can push Gemini into Search at scale, while OpenAI must prove ChatGPT feels snappier and reliable for agentic work. You’ll learn how marketers should respond now: multi-source models, measure cost-per-outcome, and shift from keyword SEO/PPC thinking to AEO with schema, FAQs, and answer-first content.