Is the AI Bubble About to Pop? Insights on the AI Bubble Prediction for 2026

TL;DR Summary AI Bubble Fears

The “AI bubble” narrative is fuelled by market concentration, capex intensity, and ROI timing, and those are valid pressure points. (Sky News)

But the counterweight is now undeniable: mass adoption, fast-forming revenue, and measurable productivity uplift thanks to new technology. This looks like a platform buildout (cloud/mobile-style), not an empty speculative loop. (TechCrunch)

My POV: automation will move revenue, reallocate labour, and expand economic capacity. The question is not “does AI work?”—it's “who captures the surplus, and how fast?” (IMF)

Why the “AI bubble” now?

Sky News frames the risk clearly: today's equity leadership is unusually concentrated, especially in Silicon Valley, and a big slice of near-term growth narratives is tied to one dominant approach (LLMs) and an enormous infrastructure buildout. It points to concerns that profits have not yet matched the scale of spending, and raises the possibility that if confidence breaks, the 'blast radius' could extend beyond a few VCs. (Sky News)

That framing isn't irrational. When markets are dominated by a narrow theme, investors naturally ask: Are we overpaying for future earnings and future profits that may arrive later than expected? Sky also highlights the “scaling question”—the idea that more compute keeps improving benchmarks, but real-world reliability still has gaps. (Sky News)

So yes: the sceptics have a case that expectations can outrun reality in the short run.

AI Bubble Meaning

The term "AI bubble" encapsulates the tension between optimism and caution surrounding the rapid rise of artificial intelligence technologies. At its core, it reflects a concern that current valuations and investments in AI may be inflated propped up by speculative enthusiasm rather than robust fundamental performance. As highlighted by various analysts, this environment sees a concentration of market power among a few key players, particularly those championing large language models (LLMs) and extensive infrastructure investment.

Yet, amidst these concerns lies an undeniable momentum: the swift adoption of AI technologies is translating into tangible revenue streams and productivity enhancements across multiple sectors.

AI Bubble Burst Prediction

As the AI landscape evolves, speculation intensifies around whether the current momentum can withstand the pressures of economic realism. The fear of an 'AI bubble burst' looms large, with many experts warning that if market confidence falters, it could lead to a sharp correction that reverberates through tech sectors and beyond.

Data that makes “AI bubble” an incomplete conclusion

1) Usage scale: this is no longer a niche technology

The simplest rebuttal to “bubble” is that generative AI has already become a mainstream interface. OpenAI CEO Sam Altman stated that ChatGPT reached 800 million weekly active users by early October 2025—up from 700 million in August and 500 million at the end of March (as reported), alongside 4 million developers building with OpenAI and very high API throughput, despite the scepticism that surrounds its rapid growth. (TechCrunch)

Whether you love or hate ChatGPT, that is mass-market distribution. Bubbles can exist with real usage, but real usage at this scale usually indicates a durable behavioural shift: people are not merely speculating—they are changing how they search, write, code, and learn under the influence of Google's parent company, Alphabet.

2) Revenue formation: monetisation is real, even if profits lag capex

CNBC reported OpenAI hit $10B in annual recurring revenue (ARR) by June 2025, spanning consumer products, business offerings, and the API. (CNBC)

CNBC later reported that OpenAI's ARR had jumped to $13B (up from $10B in June) and suggested it could top $20B by year-end, alongside 5 million paid ChatGPT business users (as reported). (CNBC)

Those numbers matter because they puncture the lazy “there is no business model” argument. The more sophisticated critique isn't “no revenue”; it's “is the revenue growing fast enough to justify the infrastructure arms race?” That's a fair debate—but it's a different debate than “bubble.”

3) Adoption “before vs after”: business uptake is rising, and household uptake is already high

On the enterprise side, U.S. Census Bureau BTOS data suggests business AI usage rose from ~3.9% (late November 2023) to ~5.4% (Feb 2024) and to close to 10% by May 2025. (Census.gov)

On the individual side, NBER research found that by late 2024 nearly 40% of U.S. adults (18–64) used generative AI for the first time, with 23% of employed respondents using it for work at least once in the previous week and 9% using it every workday; workplace adoption was as fast as the PC, and overall adoption faster than PCs or the internet at comparable stages. (NBER)

You can read those stats two ways:

Bear case: “Only ~10% of businesses” (so ROI isn't there yet).

Bull case: “In ~18 months, we moved from low single digits to near double digits, while consumers adopted at PC-speed over the long term.”

My view: the bull interpretation is closer to how general-purpose tech diffuses: consumer-first, enterprise-second, then accelerated scaling once governance and integration mature.

4) Measured productivity: the best evidence is boring

If you want proof this is economic, not just cultural, look at productivity studies in real workflows. The NBER “Generative AI at Work” paper observed ~14% productivity improvement for customer support agents and programmers, with ~34% improvement for novice/low-skilled workers, plus improvements in customer sentiment and retention indicators. (NBER)

This is the pattern of “automation as a multiplier”: it pushes best practices to the edges of the workforce and compresses the learning curve.

The Macroeconomic of AI Investments

The infrastructure buildout is not a side quest—it's the foundation. The International Energy Agency projects global data-centre electricity consumption will more than double to ~945 TWh by 2030, with AI a key driver; the IEA also notes AI-optimised data-centre demand for servers could more than quadruple by 2030. (IEA)

At the macro level, the IMF estimates AI could boost global GDP growth 0.1 to 0.8 percentage points per year in economic dollars in the medium term, depending on adoption. (IMF) Reuters reporting on IMF analysis has also pointed to meaningful economic gains that likely outweigh associated emissions costs, while emphasising the need for mitigation. (Reuters)

Meanwhile, recent reporting quoting senior policymakers and economists suggests AI-linked investment is already a significant driver of business investment and growth expectations in the U.S. (Investopedia)

This doesn't mean every AI valuation is correct. It means the spending wave is anchored in a real economic mechanism: compute enables automation; automation enables output per hour; output per hour drives margin, growth, and new categories.

Where the “bubble” risk actually lives

If we're precise, the fragility is not “AI disappears.” The fragility is:

Market concentration

When a few names dominate performance, sentiment swings get amplified. Sky flags how dominant AI-linked stocks and AI startups are in the current narrative. (Sky News)

Depreciation and upgrade cycles

Shorter hardware cycles raise the hurdle for ROI. Sky's “stale chips” concern is one of the strongest bearish arguments regarding companies like Nvidia. (Sky News)

Enterprise ROI lag

Some surveys suggest “at scale” usage remains a minority inside enterprises and that unclear ROI is a key blocker. (Barron's)

Energy constraints and public acceptance

Energy demand and emissions/water concerns are rising, and that can trigger regulatory friction or higher costs. (IEA)

A reset can happen in any of these areas. But a reset is not a “burst” in the sense of AI becoming irrelevant—it's a repricing and consolidation phase.

The missing context: the “after AI” economy data

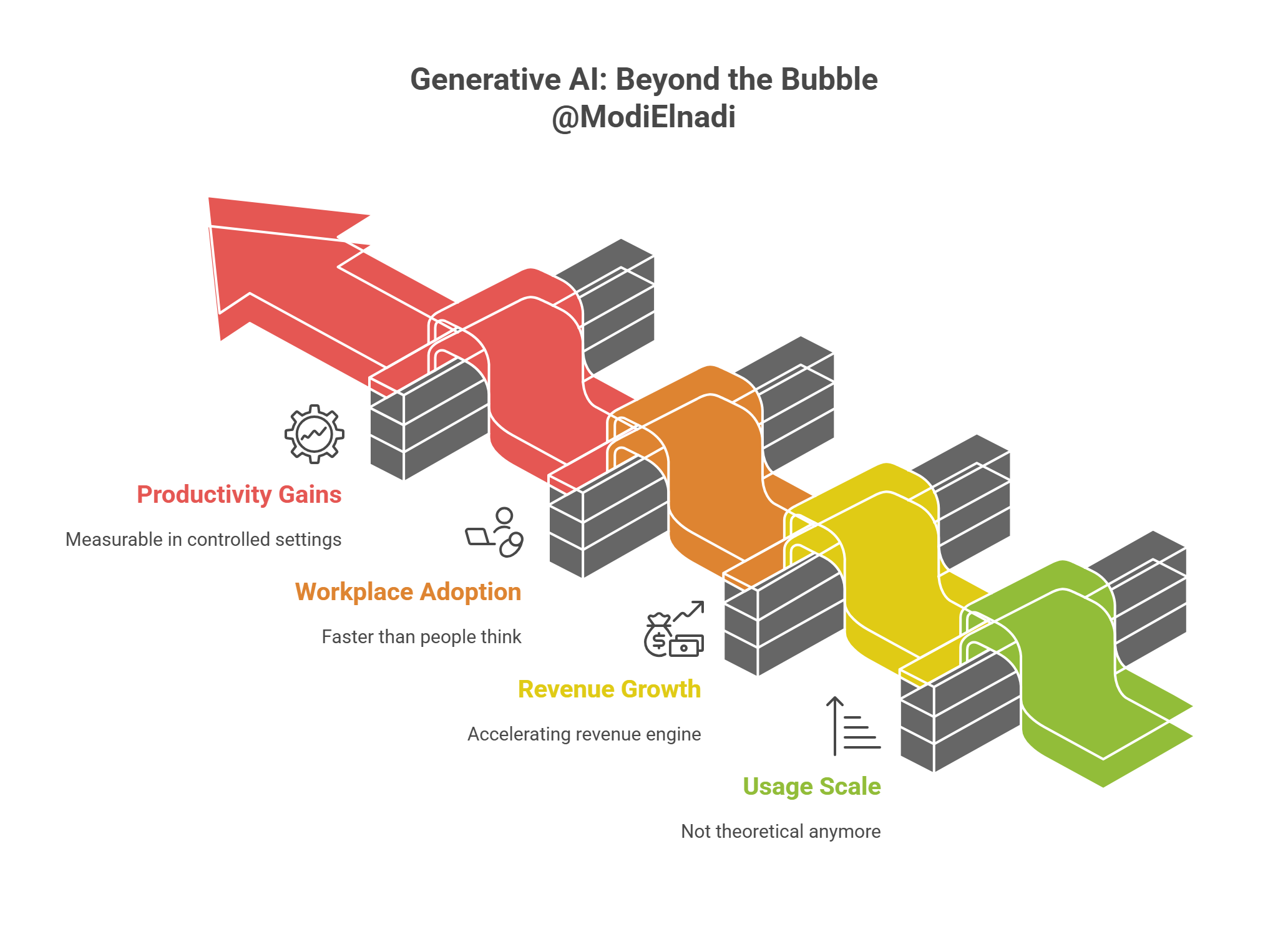

1) Usage scale is not theoretical anymore

OpenAI's CEO has publicly stated that ChatGPT reached ~800 million weekly active users (Oct 2025) through various channels, including social media. TechCrunch

Sky also references 800M weekly active users and notes that only a small share are paying subscribers. Sky News

Whatever your take on monetisation, that usage level is a signal that generative AI is now a mainstream interface layer, not a niche tech demo.

2) Revenue is growing fast

CNBC reported OpenAI hit $10B in annualised revenue / ARR (June 2025). CNBC

CNBC also reported expectations of $12.7B in 2025 revenue (source-based reporting). CNBC

This matters because “bubble” narratives often imply there's no revenue engine. There is one—and it's accelerating.

3) Workplace adoption is moving faster than people think

NBER survey research finds that nearly 40% of US adults (18–64) used generative AI by late 2024, with 23% of employed respondents using it for work at least once in the prior week, and adoption patterns as fast as the PC in the stock market (overall faster than PCs or the internet). NBER

That is not “bubble behaviour”; it's platform diffusion.

4) Productivity gains are measurable in controlled settings

The well-cited NBER study on a large customer support setting found ~14% productivity improvement on average, and ~34% for novice/low-skilled workers, alongside improvements in customer sentiment and retention indicators, contributing to economic growth. NBER

This is exactly how general-purpose technologies scale: early wins are uneven, then best practices spread.

“Before AI” vs “After AI”: a quick scoreboard

| Indicator | Before the GenAI wave | After the GenAI wave |

|---|---|---|

| Consumer AI at scale | No ChatGPT (pre-Nov 2022) | ChatGPT ~800M weekly active users (Oct 2025) (TechCrunch) |

| OpenAI commercial traction | N/A | ~$10B ARR (June 2025) (CNBC) |

| US business AI usage (survey) | ~3.8–3.9% using AI to produce goods/services (late 2023) (Census.gov) | ~10% overall use (May 2025 estimate) (Census.gov) |

| Work adoption curve | PCs and internet took years to diffuse | GenAI adoption “as fast as the PC,” faster overall than PCs/internet (late 2024) (NBER) |

| Documented productivity uplift | Automation gains, but fragmented | +14% avg in real workflow setting; +34% for novices (NBER) |

The pattern is clear: adoption and monetisation are no longer speculative—they’re measurable, even if not yet evenly distributed.

AI isn’t just a stock success story, it’s a long investment cycle

One reason “bubble” narratives are getting traction is that AI capex has become economically meaningful.

The IEA notes rapid acceleration in data centre demand and cites $320B committed by Meta, Amazon, Alphabet and Microsoft in 2025 (up from $230B the prior year), alongside rising US data centre electricity consumption (around 180 TWh in 2024). IEA

Separate reporting highlights how AI infrastructure investment is now a major driver of business investment and growth narratives. Investopedia

That doesn't guarantee every valuation is justified—but it strongly suggests this is not a hollow theme.

The Revenue Shift Will Come from AI Automation

The strongest long-term case is that AI isn't just a product; it's a cost structure and speed structure that can help mitigate risks from a potential financial crisis.

“Before AI,” teams scaled by hiring.

“After AI,” teams scale by increasing throughput per person:

faster / cheaper / faster research → faster creative testing, which likely contributes to half of GDP growth

faster / cheaper / faster build → faster product iteration, impacted by factors that include half of GDP growth

faster / cheaper / faster service → lower support costs and higher retention, both of which can play a role in half of GDP growth.

That reallocation moves revenue and GDP through second-order effects: more experiments, more launches, more personalised experiences, lower churn, and improved margins. This is why I see a boom cycle: even when one vendor stumbles, the automation dividend remains.

The cost of an AI revolution

The cost of the AI revolution is staggering, with investments in infrastructure such as GPUs and servers surging to unprecedented levels. Major players in the AI sector are investing heavily in data centers to support the growing demand for AI technologies, including data centers crucial for their operations. For instance, Nvidia's investments alone have pushed its market value to over $5 trillion, primarily fueled by the insatiable appetite for GPUs that power AI applications. However, as the financial landscape becomes increasingly dominated by these investments, concerns about a potential financial bubble loom large. Experts have raised alarms about whether the returns on these significant expenditures can keep pace with the mounting costs, especially considering the fiscal challenges that may arise if the expected benefits of AI fail to materialize. The interconnectedness of AI firms and their funding sources raises questions about the sustainability of their valuations, making this a pivotal moment in the tech industry's evolution.

As the AI sector continues to expand, the implications of its financial model become clearer. The reliance on circular investments within the industry—where companies, including AMD, fund each other to inflate their stock prices—mirrors the patterns seen during previous financial crises. This reliance on speculative financing could ultimately lead to a sharp market correction if investor confidence wanes. While the potential for AI to transform industries is undeniable, the financial mechanics underpinning this revolution must be carefully scrutinized to avoid the pitfalls of past bubbles.

Is there an AI bubble in 2026?

There are bubble-like dynamics in pockets (valuation concentration and capex expectations), but the adoption, revenue, and productivity data supports “platform buildout” more than “hype bubble.” (Sky News)

How many people use ChatGPT weekly?

As reported by TechCrunch, Sam Altman said ChatGPT reached 800 million weekly active users in October 2025. (TechCrunch)

What is OpenAI’s revenue scale?

CNBC reported $10B ARR in June 2025, and later reported ARR rising to $13B (with projections of $20B+ by year-end, as reported) and 5M paid business users. (CNBC)

What’s the best evidence AI improves productivity?

NBER research found a ~14% average productivity increase for customer support agents using a generative AI assistant, with ~34% gains for novice/low-skilled workers. (NBER)

What could cause a sharp market correction?

A correction could be triggered by slower-than-expected enterprise ROI, faster hardware obsolescence, energy/grid constraints, or a sentiment break in highly concentrated market leaders. (Barron's)

What should marketers do if the “bubble” debate continues?

Treat AI as an operational advantage: invest in AEO/GEO presence, build test-and-learn systems, measure productivity uplift, and design governance so pilots convert into scalable workflows at your AI company. (This is where winners separate: execution + measurement + compliance.)

What are the biggest pressure points?

Capex vs profit timing, depreciation/upgrade cycles, energy/grid constraints, and the enterprise ROI lag. Sky News+1

If AI valuations drop, does that mean AI failed?

No. A valuation reset can happen even when the underlying technology keeps diffusing (similar to the dot-com era: internet won; many stocks didn't).

Why is AI still “booming” despite the doubts?

Because credible research bodies estimate significant productivity and GDP upside from adoption, and businesses are prioritising deployment even if measurement lags. McKinsey & Company+2IMF+2

What should marketers do during this AI debate?

Build for automation-led growth: AEO-ready content, conversion systems that work after “answer engines,” and measurement that ties AI-enabled workflows to cost and revenue outcomes.

The big bet: bigger models = better AI

The prevailing belief that larger models equate to better AI capabilities has driven the current investment frenzy. Companies are increasingly investing in large language models (LLMs), with the understanding that expanding model sizes, training data, and computational power can lead to substantial improvements in performance. For instance, Google's parent company has made considerable strides in developing state-of-the-art LLMs, contributing to the competitive landscape. However, as these companies pour resources into creating ever-larger models, skepticism is growing around whether this approach will yield the anticipated breakthroughs.

While the scaling laws have yielded impressive results thus far, experts caution that there may be diminishing returns beyond a certain point. The expectation that simply increasing the size of AI models will continue to yield exponential gains might not hold true indefinitely. As enterprises grapple with the implications of these investments, the narrative surrounding AI's future hinges on the ability of these larger models to deliver reliable and meaningful outcomes. Investors are left to ponder whether the current obsession with size will ultimately pay off, or if it will lead to a reevaluation of what constitutes effective AI technology in the long run.

History and speculation around tech bubbles

The historical context of financial bubbles provides a cautionary tale for today's artificial intelligence investments. Past tech bubbles, such as the dot-com crash, were characterized by rampant speculation and exaggerated valuations that eventually led to significant market corrections. The current AI landscape bears striking similarities, with soaring valuations and a concentration of investment among a small group of dominant players. As companies like Nvidia and OpenAI draw massive amounts of capital, concerns about a potential bubble intensify.

The financial crisis of the early 2000s serves as a reminder of the perilous nature of speculative investments. Investors back then were lured by the promise of the internet's potential, only to see many companies fail to deliver on their lofty projections. Today, as AI technologies rapidly evolve and transform industries amid the AI boom, the question remains: will the current excitement lead to sustainable growth, or are we witnessing the early stages of another bubble? Speculation about the sustainability of AI's rapid rise continues to echo the past, urging caution among investors and stakeholders alike as they navigate this transformative yet volatile landscape.

About Modi Elnadi

I'm Modi Elnadi, a London-based AI-first Growth & Performance Marketing leader and the founder of Integrated.Social. I help brands win in the new search landscape by combining AI Marketing & PPC (Google Ads / Performance Max) with AI Search optimisation, SEO + AEO/GEO so you don't just rank on Google; large language models (LLMs) help you show up in answer engines like ChatGPT, Gemini, and Perplexity when buyers ask high-intent questions.

If this article helped you, I'd genuinely love to connect with fellow business leaders. Reach out on LinkedIn (Modi Elnadi) with what you're building (or what's broken), and I'll share a practical angle on where you're likely leaving performance on the table, whether that's prompt-led content engineering, AI visibility, or paid media efficiency. If you reshare, please tag me and I'll jump into the comments.